I thought I’d finally be at the point where I’d be able to do more frequent blog updates but it still isn’t the case. I think a part of it is not feeling like I have enough “bloggable” events happening each day between these monthly blog updates and laziness. Most of my week is going to the store from 9:30 am – 8:00 pm and then heading to the gym afterward. By the time I’m done, I’m exhausted and ready to do some reading before I head to bed.

But I really did like having a daily journal of my day. It helps me stay accountable for what I’ve done that day and what I’ve learned. It was a nice way to focus on daily incremental knowledge gains which have a nice cumulative/compounding effect over time. Maybe I’ll get back to that.

Okay, so some updates for the three primary areas of my life right now:

- The store

- Bitcoin

- Unwage

The Store

Things are still progressing with the store. It can be a bit boring and overwhelming at times when I realize how much learning and work is going into it. It’s literally like running three businesses in one location. I have to learn how to make car keys, repair Apple products, and service the water side of the business.

While I’m learning, I’m building out the store as best I can with the limited funding I have with my own two hands. The store is almost at completion and I can focus more of my time on actually learning the car key process and repair for iPhones. My hope is that I’ll have it down by the end of the year.

There is something fun about a physical store. Building a business online is great but there is a unique excitement and joy with having something physical especially when you get your hands dirty with the build-out. I know this isn’t much but it’s been a relatively fun process.

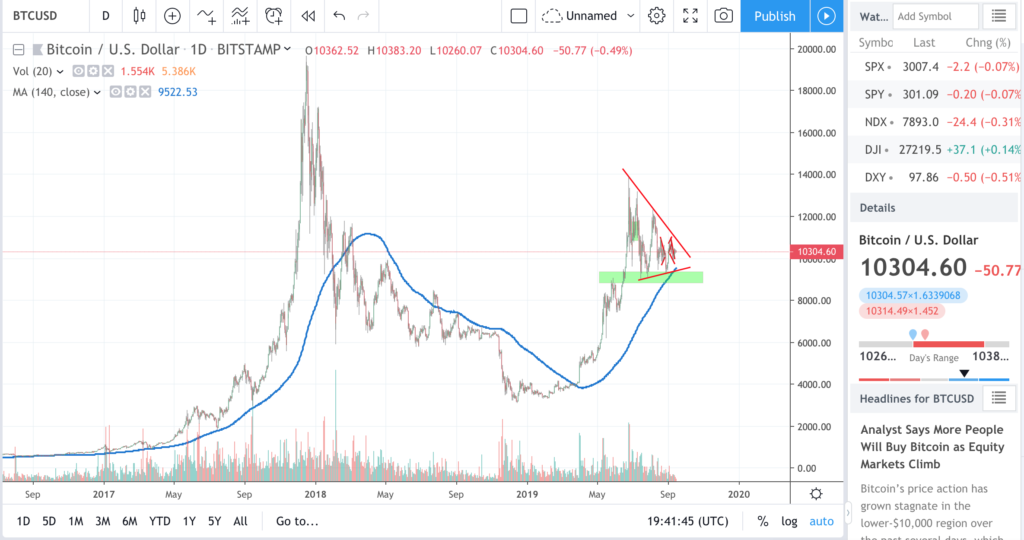

Bitcoin

I’m now at the point where I’ve put in all the lump sum money I can into Bitcoin. I also have some small gamble plays with some altcoins but most of my money is in bitcoin (98% of holdings are bitcoin). I also buy bitcoin weekly, stacking as many sats as I can while in this accumulation phase. I plan to continue to buy as much bitcoin as possible while it’s under 20k a bitcoin.

One thing I’m paying attention to more is the macroeconomic environment. The biggest concern I have is a recession. In the 10 years of Bitcoin’s existence, it hasn’t gone through a global recessionary phase and that worries me. I’m not worried about bitcoin’s value proposition nor its security, but just its short to midterm price action. I believe Bitcoin is still a great asymmetric bet in the long term just like excellent performing stocks like Amazon and Apple during its early phases (probably even more so), but I also need liquidity after it’s next bull market top.

One book that I’m reading that is helping me get a better understanding of recessionary periods is Ray Dalio’s book, Principles For Navigating Big Debt Crises. I’ve been interested in studying recessionary periods because I know that a lot of wealth can be created in these times when you know what to do. My current goal is to create as much wealth as possible before the next economic downturn and put it into safe investment allocations during the recessionary period. Once we’ve bottomed out, I plan to aggressively reposition my wealth into undervalued assets (Probably much easier said than done but I don’t expect to time everything perfectly).

I’m also not sitting on my laurels without better positioning myself within the Bitcoin space by getting more educated about it. I can honestly say that I think I’m UNDERESTIMATING the potential of Bitcoin even though I’m already highly bullish. It’s an exponential technology that can become the basis for a new financial system. This could be one of the best investments of a lifetime and I don’t plan on missing out.

These are the books I’m reading that have shifted my understanding of Bitcoin and increased my conviction.

- The Little Bitcoin Book – Jimmy Song

- Inventing Bitcoin – Yan Pritzker

- Bitcoin Billionaires – Ben Mezrich

The other way I’m increasing my understanding of bitcoin is unironically through Twitter. Twitter has become one of the best hidden social media learning platforms that I didn’t know exist. You get real-time tweets from the world’s smartest and influential people. It’s like living a book in real-time from some of the smartest authors.

Some people that have influenced my learning greatly that tweet frequently:

- Naval Ravikant

- Balaji S. Srinivasan

- Paul Graham

Here are some Bitcoin people that have increased my Bitcoin understanding and resolve (In no particular order):

- Nic Carter

- Jimmy Song

- APompliano

- Nick Szabo

- Adam Back

- Jameson Lopp

- Pierre Rochard

- BitcoinTina

- PlanB (Stock to Flow)

- American Hodl

- CZ Binance

- WillyWoo

- Murad Mahmudov

Unwage

Unwage is still on the backburner a bit since I’m working on the store. I’m trying to get some incremental progress with it so that I don’t lose my momentum but it’s been hard. With my time split between the store and following cryptocurrency development, Unwage isn’t getting the love it needs. However, I’m more excited than ever about it. It’s a good sign when I’m still excited about the project. I see it being something as a long term play that I can be excited about for a long time.

*****

That’s the update for this month.

Keep stacking sats ya’ll!